As the winter season blankets Simon Fraser University in a serene layer of snow, a select group of Master of Science in Finance students, including myself, are deep into an unparalleled journey with the Student Investment Advisory Service (SIAS) Fund. Far from being just a portfolio, the SIAS Fund stands as a cornerstone of real-world finance experience, propelling us through the complex landscape of investment management. In this moment of reflection, I’m thrilled to share insights from my tenure as an equity analyst for the materials sector of the Canadian stock market within SIAS.

The Essence of SIAS

At its core, SIAS embodies the spirit of practical learning, with a staggering market value exceeding 20 million CAD, thanks to generous donations from HSBC Canada and the Lohn Foundation. This makes SIAS not only Canada’s but also one of North America’s largest student-run investment funds. Our fund operates with a balanced investment style, segmented into four meticulously managed portfolios: two dedicated to fixed income (Global and Canadian) and two to equities (Global and Canadian), each steered by adept portfolio managers and a team of analytical minds like mine.

A Day in the Life of an Equity Analyst

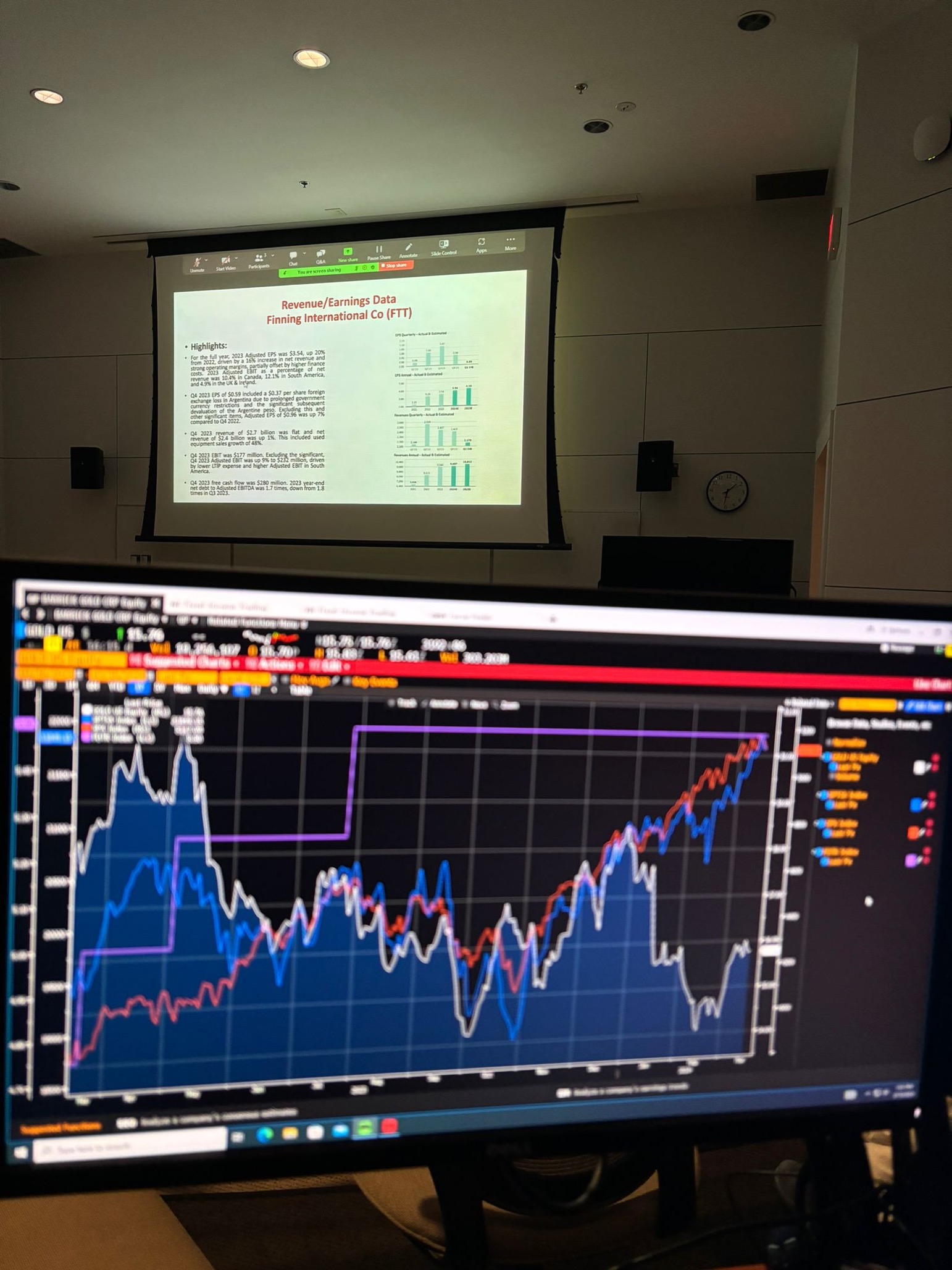

Stepping into the shoes of an equity analyst for the Canadian materials sector, my daily routine is anything but mundane. Keeping a pulse on global and local news forms the bedrock of my day, ensuring that every investment decision is informed and strategic. Utilizing sophisticated tools like the Bloomberg terminal and Capital IQ, I delve deep into macroeconomic trends, industry dynamics, and company-specific analyses.

The rigor doesn’t stop there. Through advanced financial modeling and valuation techniques, I assess potential investment opportunities, applying innovative Z Factor scoring methodology to identify high-potential stocks. My contributions support our portfolio managers in making pivotal investment decisions, aiming to outperform our benchmark, the iShares Core S&P/TSX Capped Composite Index (XIC CN), while adhering to our Investment Policy Statement (IPS) and ensuring compliance with all investment guidelines.

Learning, Growth, and Responsibility

Being part of SIAS is more than just managing a fund; it’s about embodying the principles of responsible investing. Since 2014, SFU has been a proud signatory of the United Nations Principles for Responsible Investment (UN PRI), integrating Environmental, Social, and Governance (ESG) criteria into our investment strategies. This commitment not only enhances our fund’s performance but also prepares us for a future where sustainable investing is the norm.

The opportunity to work within SIAS is transformative, honing our analytical skills and enriching our understanding of risk management and compliance. It’s a rigorous test of our capabilities, offering an invaluable head start in the finance industry.

The SIAS Teams: A Symphony of Expertise

The structure of SIAS is a testament to teamwork and expertise. With the Treasurer of the Simon Fraser University Endowment Fund as our client, our fund’s semi-active management spans across Canadian Equity, Global Equity, Fixed Income, and Cash. Each team, from Equity to Fixed Income, Compliance to Risk Metrics, plays a vital role in shaping our fund’s success, guided by the overarching strategy developed from our in-depth Capital Market Expectations.

A Call to Future Analysts

As my journey with the SIAS Fund continues, I am constantly reminded of the impact and importance of this experience. For those aspiring to carve out a career in finance, the SIAS Fund offers a unique and challenging platform to learn, grow, and succeed.

To my fellow students and prospective finance professionals, I extend an invitation to explore the world of investment management through the lens of SIAS. It’s an experience that promises not just growth but a profound understanding of what it means to make investments that matter.

___________________________________________________________

About the Author

Affan Sheikh came to Beedie from Pakistan with prior experience as a Financial Analyst. He holds a CFA Level 2 designation and has an undergraduate degree in Economics and Finance and a master’s degree in Business Analytics.